Anti-Poverty Week: Salvos research reveals tough times for Australians under financial pressure

16 October 2018

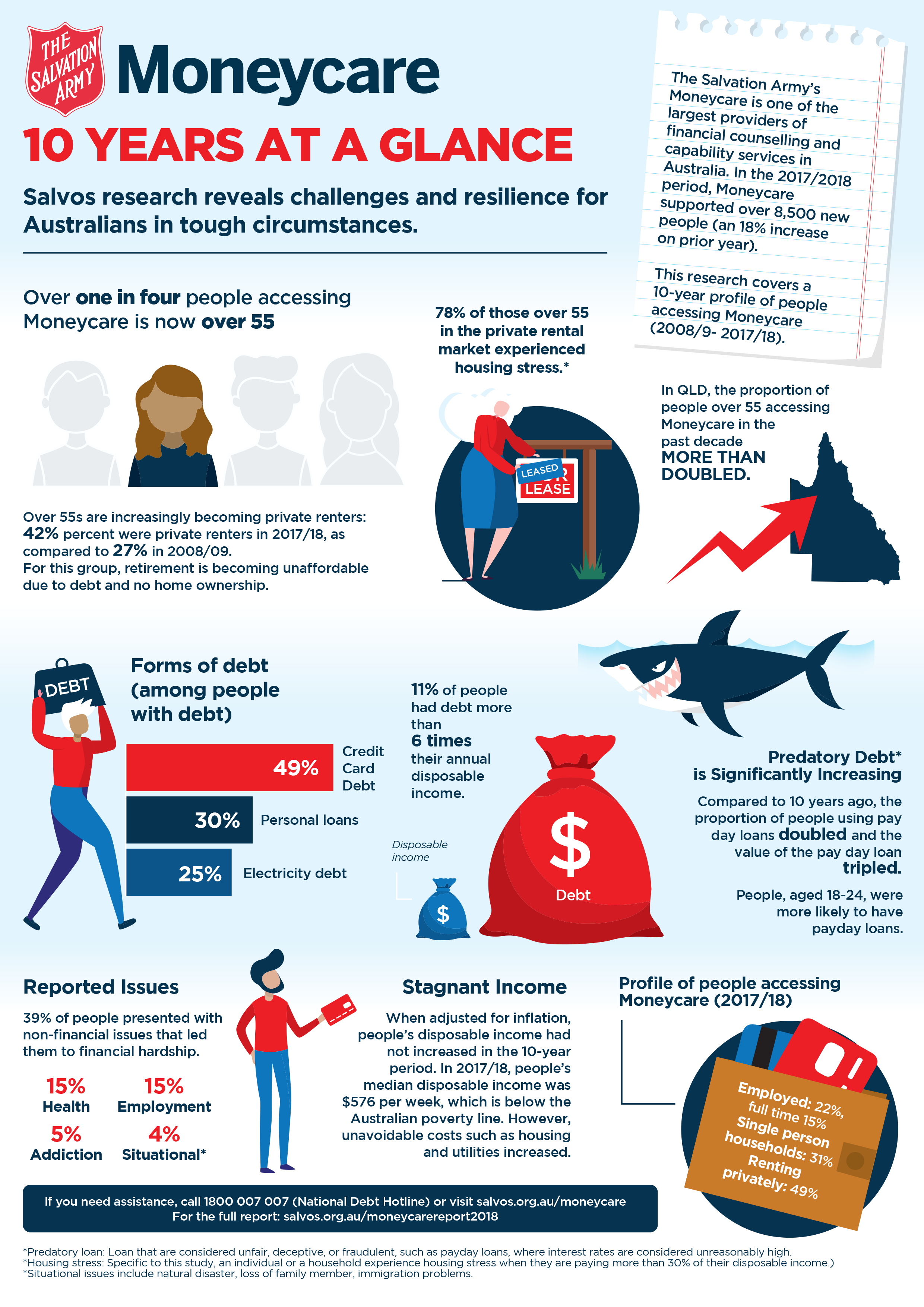

New research has revealed the proportion of people over the age of 55 accessing The Salvation Army Moneycare financial counselling and capability services has increased by 37 per cent over the last 10 years.

Moneycare is one of the largest providers of financial counselling and related services in Australia. In the 2017-18 financial year, Moneycare supported more than 8500 new clients, an increase of 18 per cent on the previous financial year.

The research, an internal analysis of nearly 30,000 people who have accessed The Salvation Army Moneycare services over the last 10 years, also found the proportion of private renters over 55 has increased by 55.5 per cent (from 27 per cent in 2008/09 to 42 per cent in 2017/18). Credit card debt has also increased among this group. This marks a significant increase in the number of people who may enter retirement in debt and without the extra security of owning a home.

Tony Devlin, the head of Moneycare, says both state and federal governments must adopt “an affordable housing strategy, including a focus on older Australians to minimise the risk of homelessness, and promote a sustainable and affordable retirement system.”

The research also found:

- The proportion of participants with pay-day loans has more than doubled, and the size of their debts to pay-day lenders has tripled in real value compared to 10 years ago.

- The most common form of debt is credit card debt (49 per cent) followed by personal loans (30 per cent) and electricity debt (25 per cent). The real value of credit card debt has increased by 38 per cent over a 10-year period.

- 39 per cent of participants presented with non-financial issues that led them to financial hardship, with the top three most reported issues being health (15 per cent), employment (15 per cent), situational (5 per cent; situational issues include natural disaster, loss of family member, immigration problems) and addiction (5 per cent).

- When adjusted for inflation, participants’ disposable income has not increased over the past 10 years. In 2017-18, participants’ median disposable income was $576, which is below the Australian poverty line, while unavoidable costs such as housing and utilities have increased.

- People in severe debt has remained prevalent with 11 per cent of participants having debt more than six times their annual disposable income.

“Our services have been able to transform the lives of people who contact us, however, the demand is great,” Mr Devlin says.

“What will help thousands of financially vulnerable Australians get back on their feet is an increase in funding and access to financial counselling, financial capability services and microfinance for low-income earners and people in financial hardship, as well as an increase in the Newstart Allowance to meet a basic standard of living and increase job seekers’ likelihood to secure The Salvation Army employment.”

The Salvation Army encourages anyone in need of assistance to contact its free and confidential Moneycare financial counselling service. For more information, please call 1800 007 007 (National Debt Hotline) or visit salvos.org.au/moneycare.

See a snapshot of the research released today below. View the full report here.