Poverty in Australia

What is poverty in Australia?

Poverty is defined as having a lack of money for immediate basic needs – such as food, housing, clothing – and for long-term savings or wealth.

In Australia, someone living in poverty or experiencing financial hardship may:

- Be struggling with debt

- Find it difficult to pay their rent or mortgage

- Not pay household bills such as electricity, water, internet, phone

- Be unable to buy fresh or healthy food

- Be unable to afford medication or medical treatments

- Be unable to heat or cool their home

- Avoid social situations (such as children’s birthday parties or work functions) due to financial constraints

- Be unable to buy new clothes or school supplies

- Be unable to afford necessary repairs for their house or car

One in eight people in Australia are living in poverty – that's three million people.

Are you having financial difficulties?

What is the difference between poverty and financial hardship?

Poverty refers to the poverty line, as defined by individual countries. The poverty line in Australia is generally defined as 50 per cent of median household income.

If someone was earning less than the below amounts (including a government income) in 2022, they were classed as below the poverty line:

- $454 a week for a single person

- $725 for a sole parent with two children

- $952 for a couple with two children

Source: Duncan A, ‘Behind the Line: Poverty and disadvantage in Australia 2022’, Bankwest Curtin Economics Centre Focus on the States Series, #9, March 2022

However, if a person cannot meet their basic physical needs (somewhere safe to sleep, food and electricity) then they are living in poverty no matter what measure is used.

Someone experiencing financial hardship refers to someone finding it difficult to keep up with their bills and other payments. This includes struggling with paying rent or mortgage, utility bills, credit cards and other loans, buy now pay later debts, school expenses and/or insurance premiums or claims excesses (health, car, life, home).

When someone is experiencing financial hardship and they do not seek help early to get on top of their money problems, it can spiral into a situation of poverty and homelessness.

Who is experiencing financial hardship or money problems?

In June 2022, The Salvation Army released a research report, Between a Rock and a Hard Place based on people who sought assistance from Salvation Army emergency relief services in the past 12 months. The demographics of the respondents provide a snapshot into who is experiencing financial difficulties.

- 73 per cent of respondents were women

- 13 per cent identified as Aboriginal and/or Torres Strait Islander – which is approximately four times higher than the total proportion of First Nations peoples in Australia

- 52 per cent of respondents lived in private rental accommodation

- Nearly 1 in 2 households were families with children or grandchildren

Facts on poverty for children and sole-parent families.

Children and sole-parent families are particularly impacted by poverty:

- 1 in 7 children under 17 are living in poverty

- Over a quarter of single parents are in poverty, with 1 in 10 experiencing severe poverty

The impact of this can be seen in Between a Rock and a Hard Place, a Salvation Army survey of people who sought assistance from our emergency relief services at some stage in a 12-month period:

- A single parent had just $22 a day to live on after paying for housing (median figure)

- 1 in 5 single-parent or couple households with children could not afford dental or medical treatment when needed

- 69 per cent of single-parent households could not afford a computer, laptop or tablet for their children

In tangible terms, this looks like:

- Children missing out on normal activities such as school excursions, birthday parties or joining a local sports team with their friends

- Being unable to complete homework if there is no family computer or home internet

- Falling behind at school

- The lack of a secure home – if rental stress means frequent moves

- Going to school or bed hungry/being under-nourished

- Missing out on birthday or Christmas presents

- Not receiving medications or medical treatment

- Only wearing second-hand clothes

- Witnessing the mental stress of a caregiver

- Long-term consequences on children’s health, wellness, mental health and development

- Limiting education opportunities and employment outcomes

Source: ‘No Child …’ Child Poverty in Australia, the Brotherhood of St Laurence

Housing stress for renters contributing to poverty

As Australian housing prices continue to reach record highs, rental prices also increase. These costs are not manageable or sustainable for low-income earners and government income support recipients – and it causes housing stress.

Housing stress is typically described as lower-income households that spend more than 30 per cent of gross income on housing costs (ABS 2019).

Extreme housing stress means paying more than 50 per cent of your income on rent/mortgage.

In Between a Rock and a Hard Place, a study of people who sought assistance from Salvation Army emergency relief services in the past 12 months, The Salvation Army found:

- 82 per cent of sole-parent and couple households with children experienced housing stress

- 56 per cent of all respondents in private rentals and 52 per cent with mortgages experienced extreme housing stress

When people are spending so much of their income on housing, there is little left for other basics such as food, clothing or medicine. Consider these poverty statistics:

- After paying for housing costs, more than 9 in 10 (93 per cent) respondents were living below the poverty line

- After paying for housing costs, 98 per cent of households with children were living below the poverty line

What impacts do people in poverty experience?

A lack of resources can prevent people with financial difficulties from engaging in social or leisure activities. This can lead to social isolation and loneliness, along with other mental health concerns.

Financial hardship can also affect people’s physical wellbeing if they are unable to afford nutritious meals, medical treatments or exercise; educational outcomes due to a lack of internet or computers; and employment opportunities perhaps because they’re unable to afford education or a necessary skill such as a driver licence.

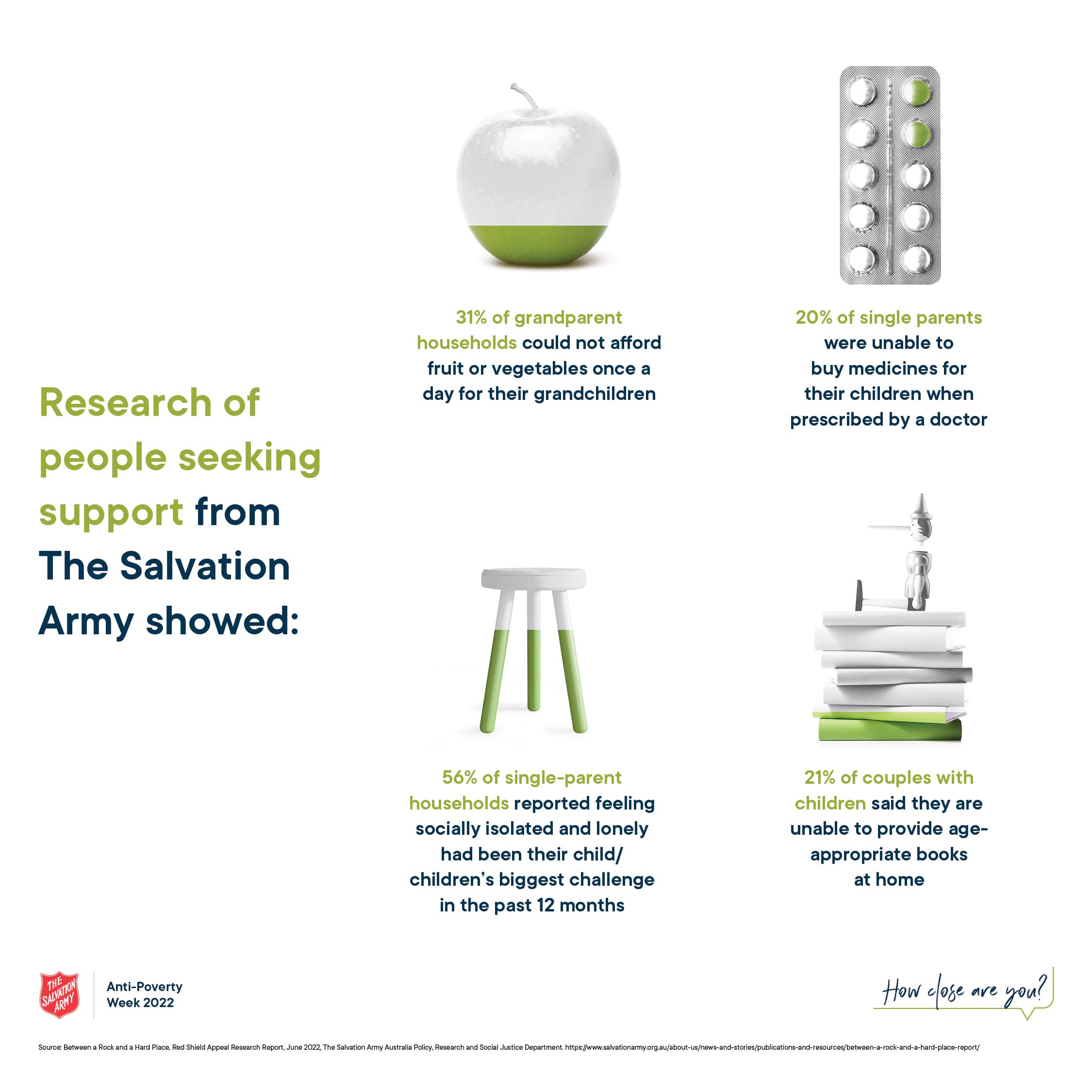

Research of people seeking support from The Salvation Army showed:

- 31 per cent of grandparent households could not afford fruit or vegetables once a day for their grandchildren

- 20 per cent of single parents were unable to buy medicines for their children when prescribed by a doctor

- 56 per cent of single-parent households reported feeling socially isolated and lonely had been their child/children’s biggest challenge in the past 12 months

- 21 per cent of couples with children said they are unable to provide age-appropriate books at home

What causes financial hardship or poverty in Australia?

There are lots of reasons why someone may find themselves facing money problems. Illnesses, injuries, job losses, global economic impacts, the rising costs of housing, living and interest rates, sudden changes to family circumstances such as a divorce, death or family violence, or natural disasters can all lead to financial hardship.

Recent events have drastically impacted the cost of housing and living. For someone already living close to the poverty line, a $10 per week rent rise, electricity increase, petrol bump or add to the grocery shop can become the breaking point. Add to that a missed repayment on a buy now pay later loan – often used on essentials like nappies or whitegoods – and the spiral of financial difficulties can become overwhelming.

Salvation Army internal research conducted in August 2022 identified these statistics about poverty:

- Almost 1 in 7 (14 per cent) Australian households have gone without basic essentials like food and heating over the past three months due to a lack of money

- Nearly half (47 per cent) of Australians have struggled to pay for essential household expenses such as petrol, groceries or a household bill in the past three months

Unfortunately, the future for these households seems bleak.

- Over 9 in 10 (92 per cent) Australians are somewhat or very concerned about the cost of living in Australia at the moment (The Salvation Army Internal Research, August 2022)

- 32 per cent of Australian families expect to be worse off financially this time next year (Roy Morgan Consumer Confidence, 25-31 July 2022)

Thankfully, The Salvation Army can offer hope to people experiencing financial difficulties.

How is The Salvation Army helping people in poverty and financial hardship?

For over 140 years, The Salvation Army has been coming alongside Australians facing hardship and crisis with support and care. In 2020/21, The Salvation Army provided more than 1.88 million sessions of care across all social programs.

Through our local financial assistance service – Doorways – we meet people’s basic needs such as food or household bills.

In the data collection period of January to June 2022, The Salvation Army’s Doorways emergency relief services have:

- Assisted nearly 68,000 people

- Provided nearly 125,000 sessions of care to people in need

Source: (The Salvation Army Policy Research and Social Justice, EMC stream data summary report, August 2022)

The Salvation Army also offers a free financial counselling service called Moneycare. Our professional counsellors help people manage their debt and loans, offer support with money management including savings plans and budgeting, organise no interest loans and provide free financial skills-building education.

In the data collection period of January to June 2022, The Salvation Army’s Moneycare financial services have:

- Assisted nearly 7000 people

- Provided more than 28,000 sessions of care to people in financial need

Source: (The Salvation Army Policy Research and Social Justice, EMC stream data summary report, August 2022)

Karin's story

Read the story of Karin who found relief from her financial struggles by reaching out to the Salvos.

Read Karin's storyThe Salvation Army is also involved in advocating for people experiencing poverty.

We take an active role in promoting the message of Anti-Poverty Week (16-22 October), which is a national campaign, supported by a wide range of Australian charities. During Anti-Poverty Week – and throughout the year – we work to raise awareness of the financial struggles impacting many Australians.

By raising awareness in the general community around financial hardship faced by Australians and sharing facts about the reality of poverty in Australia, we encourage people to join us on this journey of working for justice, growing healthy communities and caring for people.

Our teams also advocate at a government level for improvements to the cost of living, increases to government support payments and improved social housing.

What can Australians do about poverty?

Building your financial skills or reaching out for support from The Salvation Army if you are close to poverty is a good first step. Sharing the message so others can do likewise is also helpful.

As a nation:

- We can ensure that welfare levels match the actual cost of living and looking for work – importantly, we also need to make sure they never fall below the level where a person reliant on them can live with dignity

- We can improve the regulation of the short-term credit industry and increase protections against predatory lending practices

As individuals:

- We can recognise that hard times can come to anyone and that no one chooses to find themselves without sufficient income

- We can fight against the stigma of seeking help by accessing and promoting services like financial counselling and emergency relief services

Speak to local member

How to write to your local member about taking action against poverty.

Learn moreOur Social justice report

Read more in A Pathway to Social Justice published by The Salvation Army.

Read moreWhat help is there at The Salvation Army for people experiencing poverty or financial hardship?

If you or someone you know is experiencing poverty or financial hardship and is unable to buy food or other essentials, please contact us today for urgent financial assistance. Our Salvation Army Doorways team is able to support you with meeting your basic needs.

To take proactive steps and get on top of your finances today, please contact Moneycare on 1800 722 363, learn more about Moneycare financial counselling or access our free resources. We also can support you with access to the No Interest Loans Scheme.

To find out which Salvation Army service is right for you and your situation:

or learn more

What other resources exist for people experiencing poverty or financial hardship?

You can also find additional information or services through this sources:

Australian Financial Complaints Services – complaints and disputes related to financial services

Moneysmart – for free financial tips and resources

Ask Izzy – for a location-based search tool for a variety of services

National Debt Helpline – support with your debt